|

Sanders Research Associates Special Report:

The US Trade Deficit

Chris Sanders

20 August, 2004

http://www.sandersresearch.com

Re-printed with permission of the author.

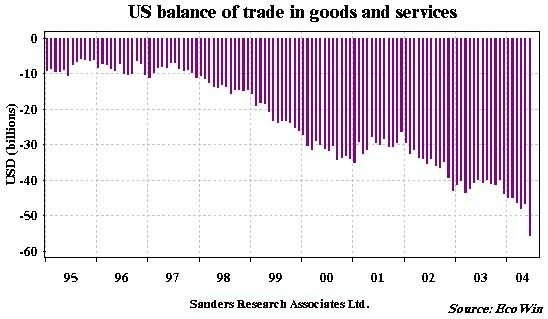

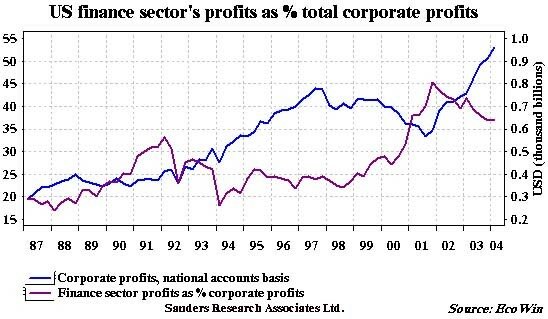

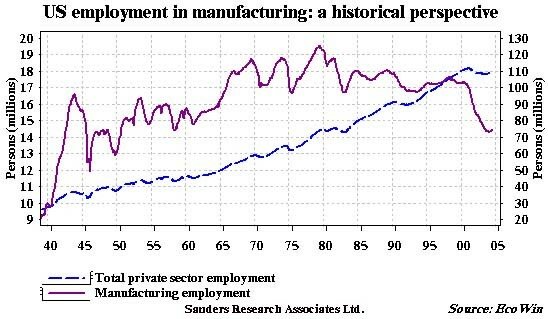

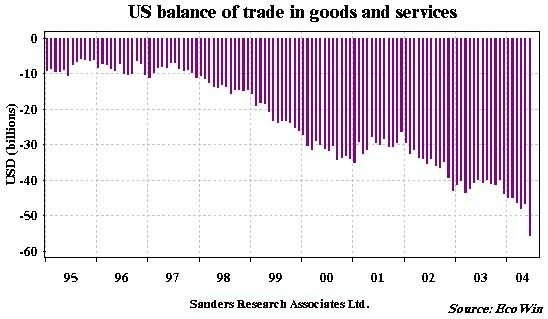

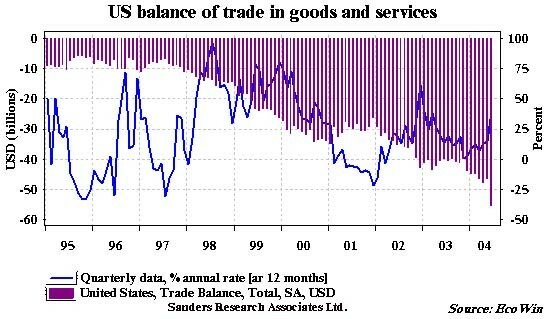

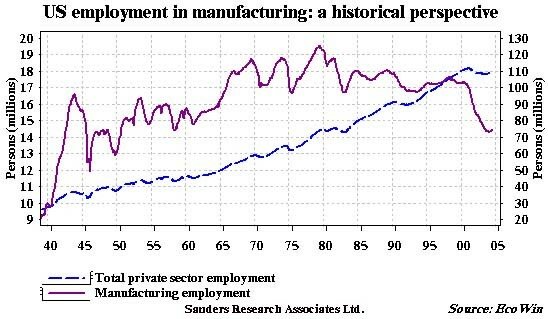

The announcement on Friday the 13th of August that the US trade deficit had grown by more than $8 billion is deeply significant.[1] Its meaning is that the US has entered a phase, long predicted by us, in which it is impossible to stabilize the American external position within a democratic and free market context. The long ascendance of finance capital from its nadir during the depression of the 1930s and the parallel erosion of real capital accumulation is reaching, in our view, a climax.[2] What appears to be the permanent loss of over three million manufacturing jobs[3] in the last three years testifies to the tacit acceptance of this state of affairs by the managers of the US political economy. This acceptance is emphasized by the Kerry candidacy for the presidency, which underlines the cross-party stranglehold that finance capital holds over the political system. There is nothing new about this; what matters here is that the numbers are evidence that we have reached a point of departure for radical systemic change.

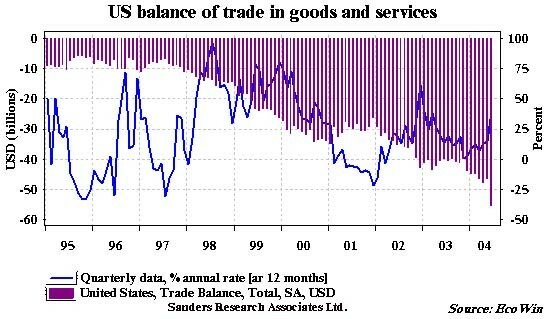

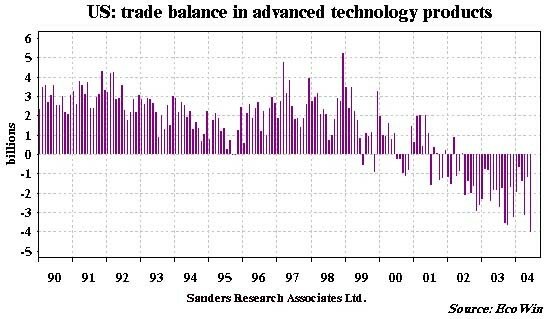

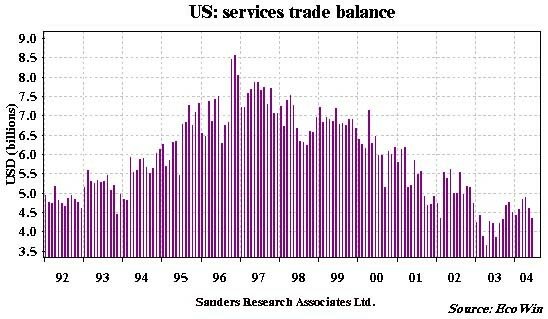

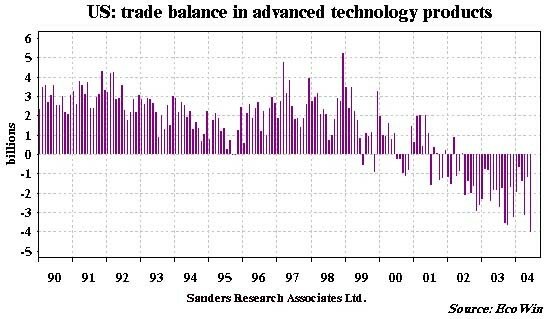

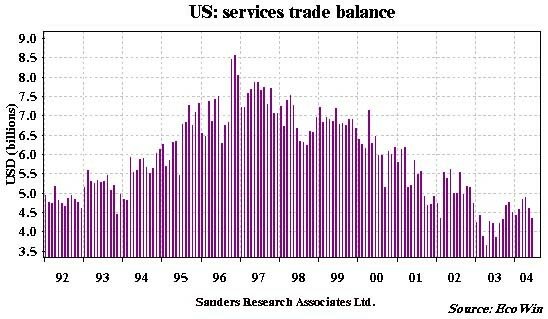

A detailed look at the breakdown of the trade numbers makes the point quite clearly.[4] With no significant part of the world is the US improving its trade balance. But apart from geographic universality what really stands out is the deterioration across commodity classes. In category after category, the US runs deficits, including its vaunted high tech sector. The last statistically significant area of surplus, services,[5] has been in trend decline since the middle 90s. A projection of that trend suggests that it too will fall into deficit in 2005.

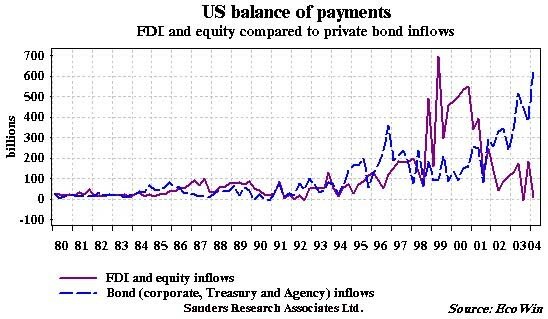

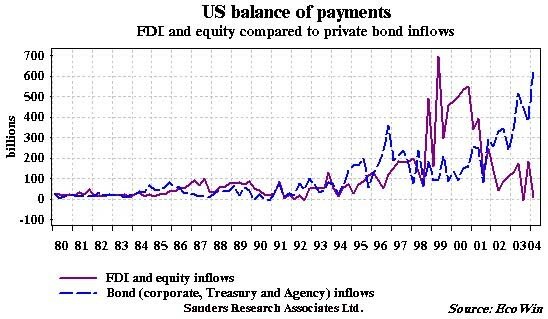

It is not an accident that the US external position, which had been stabilizing in the wake of the recession in the early 90s, began to deteriorate again from the mid-90s onward. The year 1995 was the beginning of the "strong dollar policy" of Robert Rubin. Heartily endorsed by the international financial community, which made so much money from it, the strong dollar policy was in fact evidence of underlying economic weakness, not strength. It facilitated financial capital imports in the form of FDI (foreign direct investment) and portfolio flows that easily financed the growing deficit on the trade and current accounts.[6] This predictably fell apart with the stock market collapse in 2000.

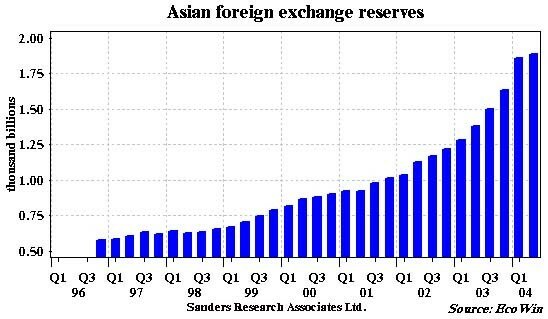

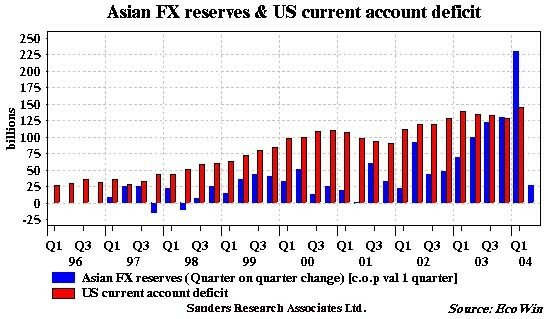

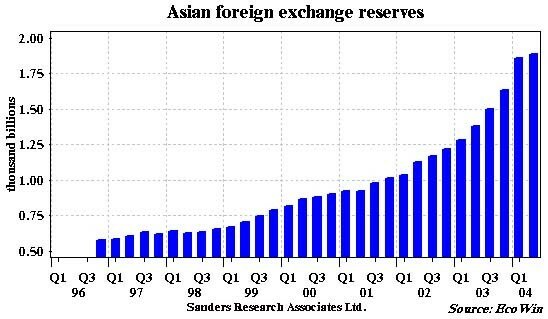

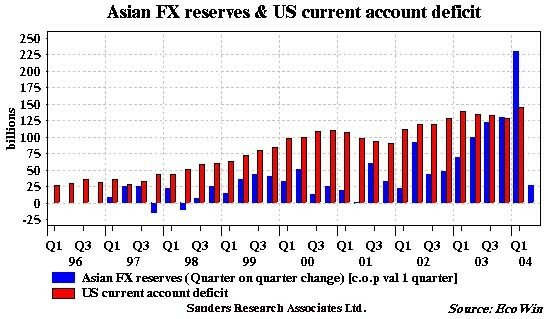

Those capital inflows fell along with the market in spite of the burgeoning need for foreign credit that was the result of the monetary reaction to the stock market's fall. The private sector has ceased to purchase American companies and real estate, shifting assets aggressively into debt instruments.[7] The net impact has been to reduce the increase in private sector credit necessary to finance the burgeoning demand for credit arising from the US war effort. The shortfall has been filled by foreign official accumulation of dollars and Treasury bonds. The question of the hour is: how long will this continue?

The answer is unfortunately a messy one: as long as it takes. The US has chosen to address the problem that it does not make enough of what the rest of the world wants by going to war to monopolize control of the supply and distribution of what the world needs, petroleum. There are other war aims, of course, but control of the global hydrocarbon net is certainly the most important. One may believe otherwise, but then one may believe in magic and the tooth fairy too. The truth is that the dangerously destabilizing idea has rooted in Washington that, in the words of Vice President Cheney, "deficits don't matter (we proved that in the 90s)." He is right of course in pure power terms; a fuller expression of Cheney's dictum might well add, "as long as we are able to force everyone else to accept them (deficits)."

Control of oil is essential to enforcing that acceptance since—the conceit of the financial markets notwithstanding—economic growth is first a function of energy availability, not interest rates. The problem for the Americans is—control of the political system by the financial fraction of the ruling class notwithstanding—that most of the "real capital" fraction, that is to say the owners of the country's factories, are opting to decamp and make things where labor can be more readily exploited in order to keep their profit margins up. Matters are further complicated by the power of the military and security complex, whose members' prosperity was, until the 90s at least under Clinton, underwritten by the country's productive capital. With the factories going to China, the viability of the management-labor compact and tax base that supports the military is eroding.

You might think that the soldiers would be a pressure group arguing for autarky and domestic economic and political reform. That may still happen, but there is no sign of it yet. As nearly as we can tell, the neo-conservative ideologues, who should really be called neo-liberal ideologues, are in the driver's seat at the Pentagon, the intelligence agencies and the Congress. Their agenda is global, not national, and their objective is monopoly, not free markets. This is an all-or-nothing let's-roll-the-dice group of thinkers who are nothing if not bold. Their problem is that in the present configuration of international power, time is not on their side. They have been in the ascendancy for several decades, and having seized control of the world's petroleum net now face the considerably more difficult task of consolidating that control and extending it to cover end users.

Since the end users are being forced to finance this venture like it or not, talking to them is not optional. It is vital to success. America needs a diplomat, not a soldier, in the White House, although in the degraded state of contemporary American democracy, the diplomat apparently needs to be or have been a soldier to get there. Whether a Kerry administration could finesse the problem or not is another matter. The defining characteristic of war is uncertainty, and this war's price is being paid in much besides dollars. The shaken member of the American basketball squad in Athens who spoke of the hatred of the crowd and the evident impotence of the Marines in Najaf are manifestations of that price.

Chris Sanders

[1] The growth of America's trade imbalance is accelerating.

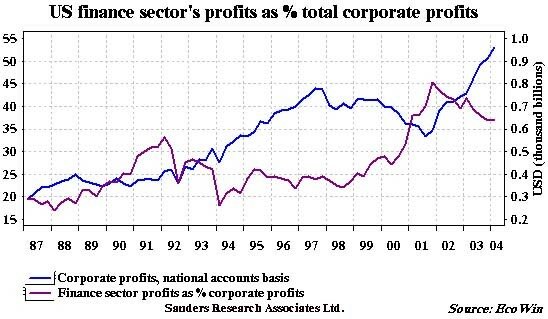

[2] This can be seen graphically, for example, in the growth of finance sector profits at the expense of the real sector. Even this understates the extent of this development, however, as most large American industrial companies have become finance operations.

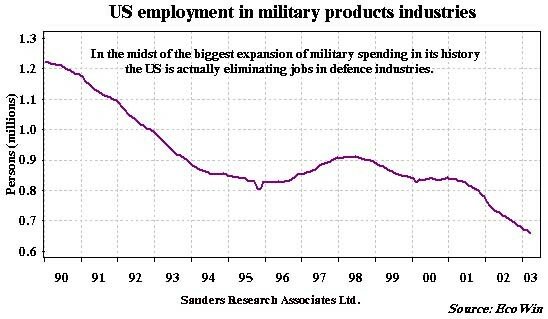

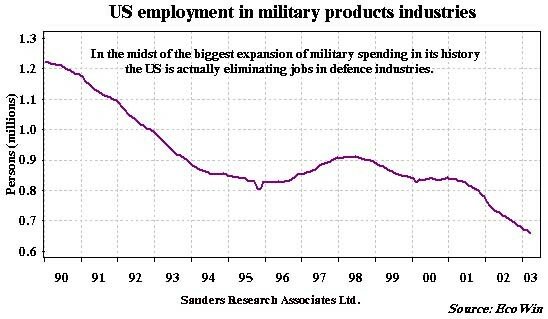

[3] The collapse of manufacturing employment suggests an abandonment of any pretence on the part of capital to maintain a labor/capital compact consistent with republican democracy. In other words, capital is getting out with the assets, leaving labor in with the liabilities of the country. The disintegration of the labor capital compact is perhaps best illustrated by employment in military products industries, which in spite of the manifest militarization of American society, is actually falling as well. This sector represented one of the most privileged sections of the work force . No more.

[4] The US simply does not sell anything that the world wants. See for instance the balance of trade in advanced technology products.

[5] Services have for many years been touted as the replacement for real production. This is a silly idea, the vacuity of which is graphically illustrated here.

[6] Private flows were the hallmark of the Rubin Treasury. Today, the consequences of the Rubin Treasury policies are being financed with "public" money, illustrated here by the foreign exchange reserve balances built up by Asian countries.

[7] The international private sector has stopped committing additional funds to the US, preferring instead to swap equity and FDI (foreign direct investment) investment for debt instruments, which are higher on the food chain in bankruptcy proceedings. The massive increase in the amount of cross border financial flows with an associated increase in market volatility is one of the reasons that income and wealth distribution is becoming more and more skewed toward "the wealthy," i.e. capital.

|